C4D Partners goes ‘traditional’ with India fund

The impact investor seeks to back early-stage social impact companies with its first country-specific fund of $75 million.

Impact investor is raising $50 million for its maiden India fund as it seeks out “mostly traditional types of companies” to back. It has a green-shoe option to raise an additional $25 million for the new fund.

The firm, which is backed by Dutch nonprofit ICCO Cooperation (acquired by Cordaid Investments), already has an Asia Fund of $30 million, of which it has deployed nearly $20 million across 11 companies in India, including Arohan Foods and Ananya Finance. Other investments have been in Indonesia, the Philippines, Nepal, and Cambodia.

With the India-focused fund, C4D plans to invest in up to 20 early-stage companies over the next four to five years. The Asia fund is also likely to see its first exit from the Indian portfolio.

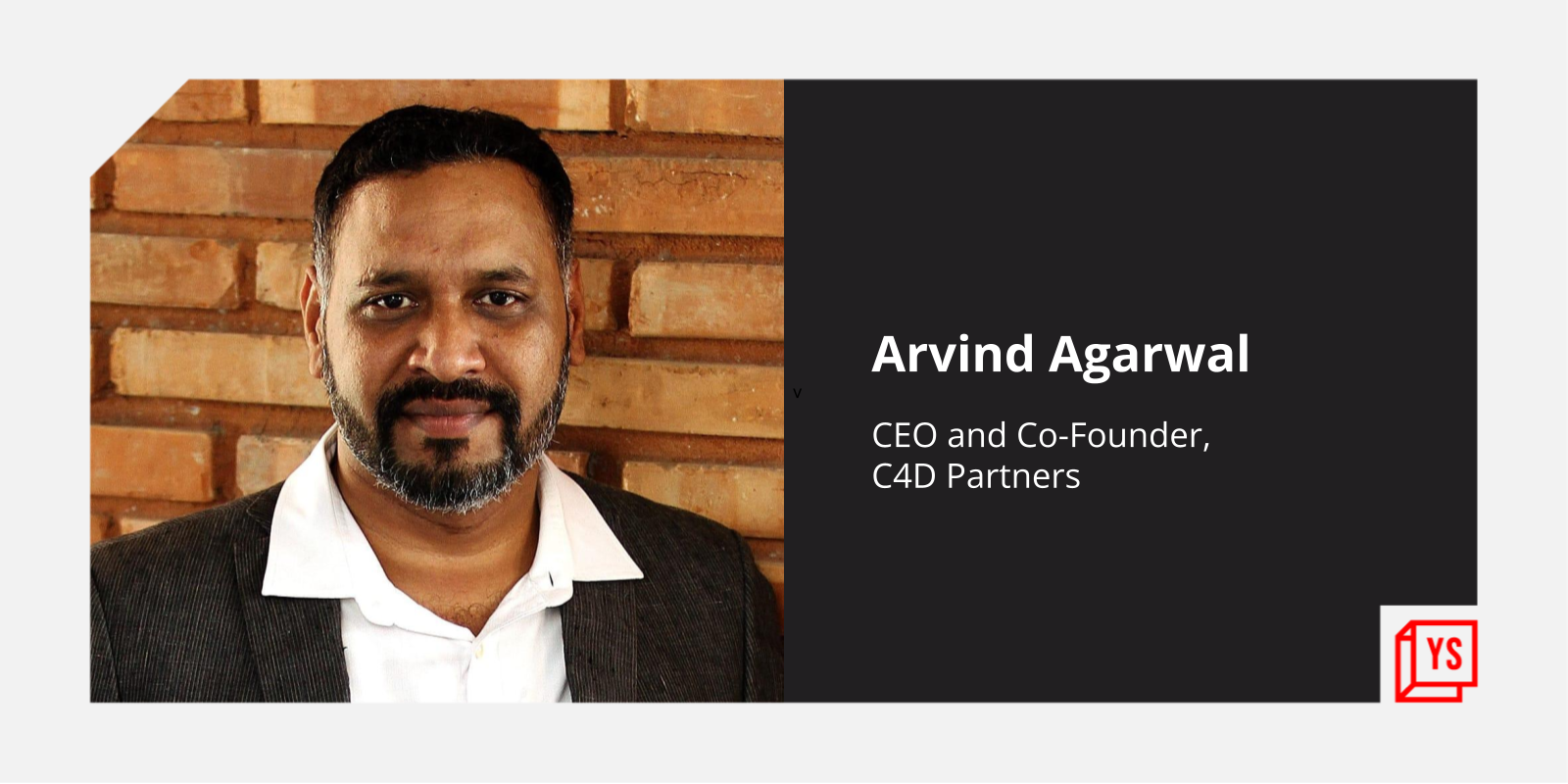

"A key criteria for our investment thesis is livelihood impact for the bottom-of-the-pyramid population, which is mostly traditional types of companies,” Arvind Agarwal, CEO and Co-founder of C4D Partners, told YourStory.

“We will focus on healthcare rather than healthtech, education rather than edtech, agriculture rather than agritech. We want to try and stay away from the tech-led marketing story.”

C4D Partners is raising $50 million for its maiden India fund

The India fund expects to raise its first tranche of funds by mid-2023. It has applied for registration with SEBI as a Category I Alternative Investment Funds, which are funds that back ventures involved in “what the government or regulators consider as socially or economically desirable,” as per the market regulator.

“From the Asia fund, we have made investments ranging from $300,000 to $4 million. Since the India fund is going to be larger in corpus, we will write the first cheque in the range of $500,000 to $2 million and reserve $3-4 million for the follow-on rounds,” said Arvind, adding that C4D also plans to float a South Asia Fund.

With the India-focused fund, Arvind said C4D Partners will continue with its approach of being the first institutional cheque in its portfolio companies, coming in at the seed or Pre-Series A fundraising stages.

It will also look to rope in one of its existing Limited Partners in its earlier fund as an anchor investor in its India fund. “We have not started reaching out yet but one of our existing investors is expected to anchor it. Our target base is going to be Development Finance (DFi) institutions. The idea is to get a 50-50 or 40-60 kind of mix between Indian investors and foreign investors, outside of Europe,” Arvind said.

C4D Partners was incorporated in 2013 as part of ICCO Cooperation as an evergreen fund and later spun out as a separate entity in 2017 with the fund managers buying out the portfolio. Investors in C4D Partners’ Asia Fund include Dutch Good Growth Fund, Finland-based FCA Investments and the Australian government initiative, Investing In Women.

The India fund will be sector-agnostic, said Arvind, although it will not invest in sectors such as microfinance and technology-heavy investments.

“We are an impact fund and unless there is strategic value coming from it, we will not touch microfinance institutions,” said Arvind. “Also, financial institutions have a lot of interest from all types of investors and we will stay away from it. The other thing which we try to stay away from are tech-heavy investments.”

(This story was updated to add details on ICCO Corporation's ownership and investment in portfolio companies in India.)

Edited by Feroze Jamal