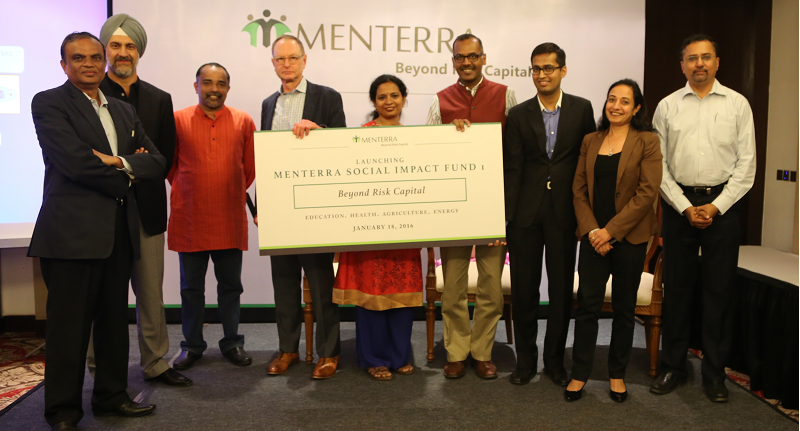

Menterra Social Impact Fund I is bridging the gap and rooting for impact

Menterra Venture Advisors announced the launch Menterra Social Impact Fund I. True to its name, Menterra, which means the land of mentoring, is a fund that aims to handhold entrepreneurs and take them on the journey from seed to angel and finally series investments. The fund is a Rs 40-crore impact investment fund that will invest in early-stage social enterprises working in the sectors of education, health, agriculture and energy. The ticket size is between Rs 1 crore to Rs 4 crore.

Paul Basil, Founder, Villgro, says,

Villgro is growing, we’re scaling wide, broad, and deep. We are building the conveyor belt of support where entrepreneurs can seamlessly go through the cycle and secure additional capital to grow their enterprise. There is huge capital aggregation happening at the angel stage and equal amount of aggregation happens at the series stage. We believe there is a big gap there.

Basil says that this gap is not just in terms of capital needed, but a combination of the need for capital, high-quality technical assistance, and the mentoring required to take these deals from the seed stage to the series A stage.

“And that’s what we really hope Menterra will address,” he says.

He added that with the Startup India Standup India announcement, they believe that more capital, talent, and entrepreneurs will solve compelling problems that society faces today.

Mukesh Sharma, Co-Founder and Managing Director, Menterra, says,

The core of this fund is supporting entrepreneurs. A lot of entrepreneurs don’t have a business background nor are they from business families. Menterra will step in and give them guidance. We’re happy to put in the faith at an early stage and take them from ideation to a stage where revenue and traction will show.”

Paul believes that entrepreneurs should be concerned with impact, and not obsess about a solution. “They should aim to create a change in the lives of the masses, that is a non-negotiable requirement. Once they meet this criteria, we look at a couple of other parameters – one is profitability, the other is scalability, and finally is it is the ethical fibre the entrepreneur has, the integrity,” he adds.

R Ramaraj, Founder, Sify, advisor at Elevar Equity, board of governors at IIM-C and Chair of the Board at Villgro, spoke of how Menterra had emerged at the right time. He said, “It is the part of the puzzle, of the next piece of follow-on funding that is required.”

He shared the example of Ronald Cohen, also called the father of British venture capitalism, who said that social investment is the next venture capital and how social investments would have a transformative effect on society. He also cited the example of a recent study by the Wharton School of Business, which showed that social investors do not have to be concerned, as funds focusing on social impact were not going to bring any less returns than other commercial ventures.

Ramaraj elaborates on the drivers that will push social investments further. He said,

First, there is a lot of talk like the talk last Saturday, and there is all the literature, which people are going to look at and think that yes, maybe it is a good time to invest. The second driver is capital. Return and impact are very real parameters in impact investment. Another key driver is the quality of entrepreneurs, which has gone up dramatically, especially in the last two or three years. With Startup India Standup India favourable regulations have come, and that is a big win. This is right time to be in it.

The Lemelson Foundation and Michael & Susan Dell Foundation have invested in Menterra Social Impact Fund I. The fund has also secured investments from eminent angel investors like Chandu Nair and Meenakshi Ramesh.

Also present at the launch to talk about the evolving landscape of impact investment were PR Ganapathy, President (India), Villgro; Philip Varnum, CFO, Lemelson Foundation; Geeta Goel, Director, Mission Investing at Michael & Susan Dell Foundation (MSDF); and Chandu Nair, a serial entrepreneur and angel investor. Philip said that this was the first time he saw foundations working together and a synergy between investors.

Speaking about opportunities, Geeta said, “When we look at direct or indirect investment in India, people often say that India has a large population and hence has ‘demographic dividend’. Compared to the rest of the world, the advantage that India has from the impact investment st andpoint is that even at the grassroots level, we’re very entrepreneurial as a society.”

She added that the market at the bottom of the pyramid already exists, but is served by unregulated outlets. “What impact investors and entrepreneurs are trying to do is institutionalise the market and make it quality conscious. And that really is the opportunity in India in the impact space,” she said.

Chandu drew from his own journey from entrepreneur to angel investor and said,

Today, we’ve reached a point where I would reckon that, in India, if you want to be a socialist, democratic republic, the best way is, to create more entrepreneurs. The best way for that is for the government to help others create those entrepreneurs. The time has come; entrepreneurship is the answer and will pave the way.